Why your Business Should Invest in Solar Power in 2021

Benefits of Investing in Renewables

The threat of continuing electricity price rises, and the unpredictability of electricity costs can make it hard for Australian businesses to accurately plan for the future. Power bills have risen substantially across Australia over the last decade. The wholesale price of power has risen in recent years due to the rising cost of generating power from gas, as well as the closure of several old and inefficient coal-fired power plants.

Investing in a commercial solar system allows businesses to produce a portion of their own electricity requirements on site, removing some of this uncertainty. Unlike residential households, which tend to use more energy in the peak hours before 9am and after 5pm, most businesses operate and use the majority of their electricity between 9am-5pm.This makes Australian businesses an ideal fit for commercial solar systems.

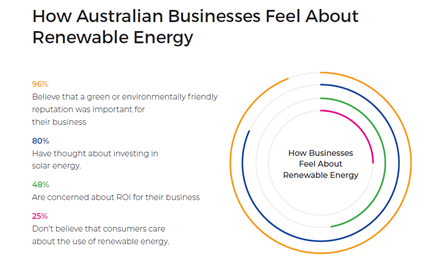

Investing in solar power is not just about the tangible economic benefits to your business though; whether you invest in renewable energy can also affect the public’s perception of your business. In 2020, we surveyed Western Australian business owners and managers and discovered that there are some interesting perceptions surrounding renewable energy and its use.

Results from our survey showed:

According to our data, a large majority of the business owners and managers we surveyed (80%) were interested in investing in renewable technology, namely solar power, but 48% of the respondents were concerned about the return on investment that renewable energy would have for their business.

Interestingly, while our respondents overwhelmingly agreed that a green or environmentally-friendly reputation was important for their business, 25% of those surveyed didn’t believe that their customers cared about whether or not they used renewable energy.

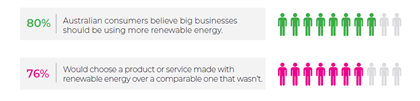

These numbers seem to be out of step with each other, as well as conflict with the actual feedback from customers; a study by ARENA found that 80% of Australian consumers believe big businesses should be using more renewable energy, and more than three-quarters (76%) of consumers said they would choose a product or service made with renewable energy over a comparable one that wasn’t.

Will Customers Pay More if a Company Uses Renewable Energy?

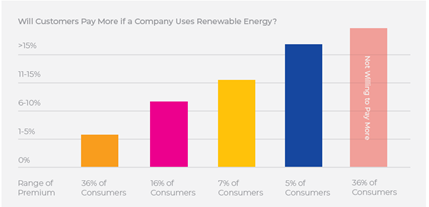

Additionally, almost two-thirds (64%) of consumers say they would pay more for products or services produced with renewable energy, as opposed to energy from fossil fuels; over a third would pay 1-5% more and another 28% would pay over 5% extra. Despite being highly price-sensitive, younger Australians are the most willing to spend extra to have their products and goods made with renewable energy, with the study finding that almost a quarter of 18-29 year-olds were willing to pay more than a 10% premium for it.

These figures are backed up by a joint 2019 study by Salmat and ACRS, which investigated the impact that ethical behaviour and corporate social responsibility (CSR) practices have on shoppers which found that:

• 34% of shoppers are willing to pay more for environmentally friendly products.

• 31% of shoppers admit to not purchasing a product due to a brand or product’s values, ethics or sustainability practices.

• 72% of shoppers rank ethical brand behaviour in their top three purchasing priorities.

What this information shows is that consumers do actually care about whether or not the companies they purchase goods and services from invest in renewable energy, and that this factors in to their purchasing behaviour, but also that many businesses are underestimating this sentiment, which may be impacting their bottom line.

How to Turn an Expense into an Asset

As a business owner, it is inevitable that you will have to pay for electricity. Whether your electricity costs are large or small will depend on your industry and operational needs, but if you are on the higher end of the scale, electricity bills can quickly become a significant cost to your business.

Installing a commercial solar system works in conjunction with your existing grid electricity supply; when your solar system is producing electricity, it is consumed on the premises and any shortfall is seamlessly provided by the grid. Any solar energy that is not self-consumed is sent out to the grid and depending on where you are located and who your electricity retailer is, you may receive a payment for this, known as a feed-in tariff. A “bi-directional” electricity meter installed as part of the solar system keeps track of these electricity transactions.

Every unit of electricity your solar power system produces that you consume on-site directly reduces the electricity you need to purchase from your electricity retailer. The value of this is determined by the rate you would have paid for that electricity; you can check how much you pay for daytime electricity on your electricity bill.

The amount of your electricity that a solar power system can offset, as a percentage of your overall consumption, will depend on the size of the solar system you install and the amount of electricity you consume in daylight hours (i.e. when the solar system is producing electricity).

Solar energy is a significant aspect of any business sustainability program; installing a commercial solar power system represents a solution which can reduce electricity costs immediately and significantly reduce your business risk going forward. With solar, you can turn the electricity expense you are already paying for into a long-term, money-saving asset for your business.

Government and Tax Incentives

In Australia, federal and state governments have put financial incentives in place to help make the outright purchase of a commercial solar power system much easier for businesses.

STCs and LGCs

Depending on the size of your project, the government will supply you with SmallScale Technology Certificates (STCs) or Large-scale Generation Certificates (LGCs). STCs are an electronic form of currency that can be purchased, sold, and traded on an open market, meaning their value fluctuates with supply and demand. It is common practice to allocate the STCs to the system provider in exchange for a discount on the upfront purchase price. STCs for renewable energy installations under 100kW in size are based on how much electricity the system will generate until 2031, with one STC equaling one megawatt-hour of electricity.

However, it’s important to note that STCs are being reduced by around 6-7% every year until 2031, when they are to be phased out completely, meaning that the sooner you invest in a solar power system, the more you’ll save on the upfront cost. Large scale systems, 100 kW and over, are not eligible to claim STCs and must instead claim LGCs. One LGC is created for every megawatt-hour of electricity your system generates. Like STCs, LGCs can be purchased, sold, and traded on an open market and their value fluctuates according to supply and demand.

To claim LGC’s, your business will need to be registered to become an “accredited power station” with the Clean Energy Regulator. Your solar installer will assist you with this process and ensure that your metering is in line the National Electricity Market standards, so that you can accurately track your generation. The key difference between STCs and LGCs is that LGCs are produced on an on-going basis, as opposed to STCs which are created upfront.

Federal Government Instant Asset Write-off

As part of the 2020 Federal Budget tax incentive announcements, the Instant Asset Write-off allows businesses the following:

1. Immediate Expensing

Businesses with a turnover of less than $5 billion will be able to immediately deduct the full cost of new, eligible assets of any value in the first year it is used or installed, before June 30, 2022.

2. Instant Asset Write-off Extension

Businesses with turnover of up to $500 million can instantly write-off multiple assets worth up to $150,000 each. The extension will now provide businesses with an extra 6 months until June 30, 2021 to first use or install assets purchased by the end of this year.

3. Loss Carry-back

The Carry-back incentive means businesses with a turnover of less than $5 billion won’t have to wait until they next post a profit to receive a tax benefit, instead businesses can receive a cash refund of taxes paid on previous profits if they post a loss.

The Instant Asset Write-off provides substantial financial support to make investing in commercial solar power easier and more affordable. It can also significantly reduce your payback period in your solar investment, so your business can start profiting much sooner. We recommend talking with your accountant to see how your business can benefit from this incentive.

The Cost of Solar

Cost is one of the main objections business owners have when they consider investing in a solar system for their business, with 70% of businesses who participated in our survey agreeing with this statement. With large commercial sized systems costing anywhere between $21,000 to over $200,000, it can be a significant amount of capital to invest in a one-time purchase.

Financing options

Thanks to flexible finance options including power purchase agreements and solar leasing, the need for upfront capital outlay is no longer necessary when investing in a solar system. Solar leasing options and PPA agreements have been taken up by companies in many different industries and is now viewed as a viable alternative to capital expenditure for companies who are planning to invest in solar.

Power Purchase Agreements

A Power Purchase Agreement (PPA) enables businesses to enjoy the benefits of solar power with no upfront capital outlay. When a business enters into a PPA with a solar power provider, the business purchases their power from the solar provider, with the solar provider supplying the solar system at the premises of the business. Total ownership of the solar system remains with the solar provider, meaning they must operate and maintain the system, so there are no on-going running costs to the business.

As self-consumed solar energy is far more cost-effective than solar electricity that is exported to the grid for a feed-in tariff, when considering a PPA, it is important to have the system optimally sized for maximum self-consumption.

A PPA can vary in terms of the length of the contract and how the business chooses to control their energy costs, however predominant benefit is that the agreement allows you to purchase energy at a cost much lower than from the grid, and knowing what the rate for the electricity will be for the length of the agreement.

Solar leasing options

A solar lease is a contract between your business and a solar provider to pay a fixed monthly amount for the solar PV system to be installed at your business premises. You will pay a pre-agreed, monthly fixed rate, like a rental agreement, which will replace a portion of your energy bill, so you end up spending less on energy straight away.

The business may still have to buy some power from the grid, depending on how much more power you use than your solar system generates, so overall costs may vary month on month. Depending on your contract, you can simply rent the solar system or you can pay it off in instalments, so you could own the equipment outright at the end of your contract (sometimes after a nominal final payment).

There are a number of reasons that a business should consider solar leasing. In many cases, the electricity cost savings generated by the leased solar PV system will more than offset the lease payments required for the system, meaning businesses often stay cash-flow positive from day one. Another of the benefits of solar leasing that is particularly appealing for businesses is the ‘fixed’ aspect of the lease payment; many businesses have much higher electricity costs in summer than they do in winter, which is also when solar panels produce the most power, so solar leasing can provide an element of bill smoothing.

There are also planning and budget forecasting benefits in the certainty of knowing what you are going to pay for power for the next few years, unlike grid electricity which typically goes up in price every year.

What to watch out for when entering into a Solar Lease or PPA

As with all major financial business decisions, if you are considering signing up to a solar lease or PPA, it’s important to ensure you read the fine print and check the terms of your contract, to ensure there are no hidden complications that can affect your business in the future.

Some of the main things to look out for are:

- The length of lease terms

- Effective interest rates on the solar lease

- Costs of early exit fees

- Your rights and obligations at the end of the contract It is also advisable to speak with your accountant to see if there are tax benefits or implications for your businesses if you choose to invest with a solar lease or PPA.

The solar provider you partner with is another important decision to factor in; you should look for a solar provider that has proven history with solar leasing and PPAs, and ask for references so you can speak with past and current solar leasing or PPA customers to learn about their experience.

For Australian businesses who are looking to invest in solar power, financing options like solar leasing or PPAs are a great solution to help reduce their business’ carbon footprint and improve their public image, without compromising their bottom line.

Non-Financial Benefits of Solar Power For Your Business

While the financial benefits of commercial solar may be the main motivation behind investing in solar for your business, there are many other additional features of solar power that can make a positive difference to how your business operates.

Positive Environmental Impact

The National Australian Built Environment Rating System, or NABERS, measures the environmental performance of Australian buildings and homes. Installing a commercial solar system will increase your building’s NABERs rating due to significantly lower carbon emissions, without the capital outlay. A commercial solar power system can also help a business directly reduce carbon emissions, as electricity generated from a solar system produces no carbon emissions. Additionally, the fact that it is generated “on site” with no transmission losses means it offsets even more than it generates.

Green Corporate Image

There is a strong need for corporate responsibility from businesses, with many customers holding this as an important value when making decisions about which companies they deal with. By installing a commercial solar system, you are making a strong visual statement that highlights your willingness to contribute to environmental sustainability and reduce your carbon footprint.

Heating and Cooling

A study at the University of California3 revealed the insulating power of solar panels, namely that daytime ceiling temperatures under solar panel arrays were up to 2.5 degrees cooler than under an exposed roof, while at night the conditions were warmer than for the exposed roof. This has the potential to significantly reduce air-conditioning and heating costs for your business.

Add to the stability of Australia’s power supply

The contribution of renewable energy generated from solar can reduce the demand on the network during the day. Reducing demand on the network during peak times can reduce the likelihood of brownouts and decreased demand on the grid can attribute to lower costs of energy during peak periods.

Going Forward

Due to the current state of events, it is difficult to determine what is likely to happen next week, let alone next year. However, cost control is always going to be a priority for businesses. For a free energy assessment, contact us to chat to one of Infinite Energy’s experienced commercial energy consultants about the options available for your business.